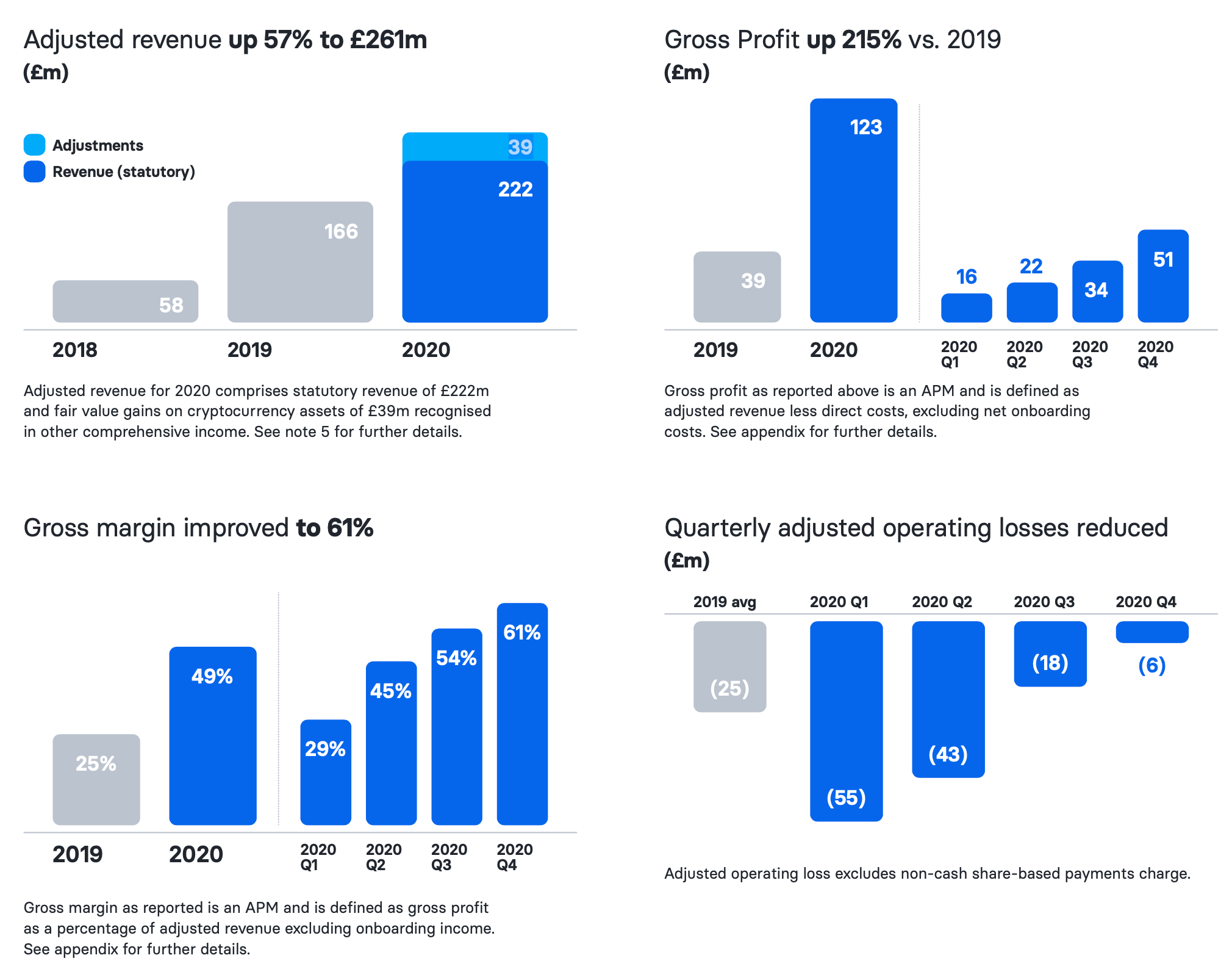

Fintech startup Revolut has filed some monetary outcomes and is sharing particulars with the press. In 2020, the corporate reported $361 million in income (£261 million) — that’s a 57% enhance in comparison with 2019 income of $229 million (£166 million).

Apparently, these income figures have been adjusted to incorporate truthful worth features on cryptocurrency belongings — it signifies that Revolut holds some crypto belongings on its steadiness sheet. Revolut made $54 million (£39 million) in truthful worth features on cryptocurrency belongings.

Gross revenue reached $170 million (£123 million) final yr. On the similar time, the corporate nonetheless studies working losses. Specifically, Q1 2020 was a very unhealthy quarter with $76 million (£55 million) in adjusted working loss.

In 2020, whole non-adjusted working loss reached $277 million (£200.6 million). Like many tech firms, administrative bills are liable for this loss. With a workers of two,200 individuals, the corporate spent $367 million (£266 million) on administrative prices alone. However issues appear to be enhancing as you’ll be able to see:

Picture Credit: Revolut

These developments aren’t that shocking as I reported that fintech startups spent most of 2020 specializing in profitability and enhancing their margins. On the finish 2020, Revolut had 14.5 million private clients and 500,000 firms utilizing Revolut Enterprise.

“Because the extraordinary circumstances of 2020 drove the development in direction of digital monetary administration we continued to innovate for purchasers to make their monetary lives simpler and speed up each day use. We launched 24 new retail and enterprise merchandise, expanded into the US, Japan and Australia and launched banking providers in Lithuania, all whereas considerably enhancing our profitability,” founder and CEO Nikolay Storonsky stated in a press release. “We started 2023 with a extra resilient and productive enterprise that may improve our trajectory in direction of fast development.”

While you examine Q1 2020 to Q1 2023, issues are radically completely different for the fintech firm. Income elevated by 130% year-over-year and gross revenue grew by 300% between Q1 2020 and Q1 2023.

Revolut has been launching a ton of merchandise to diversify its sources of income. It’s more and more changing into a monetary tremendous app with present accounts, debit playing cards, buying and selling providers, insurance coverage merchandise, premium subscriptions, cryptocurrency buying and selling and extra.

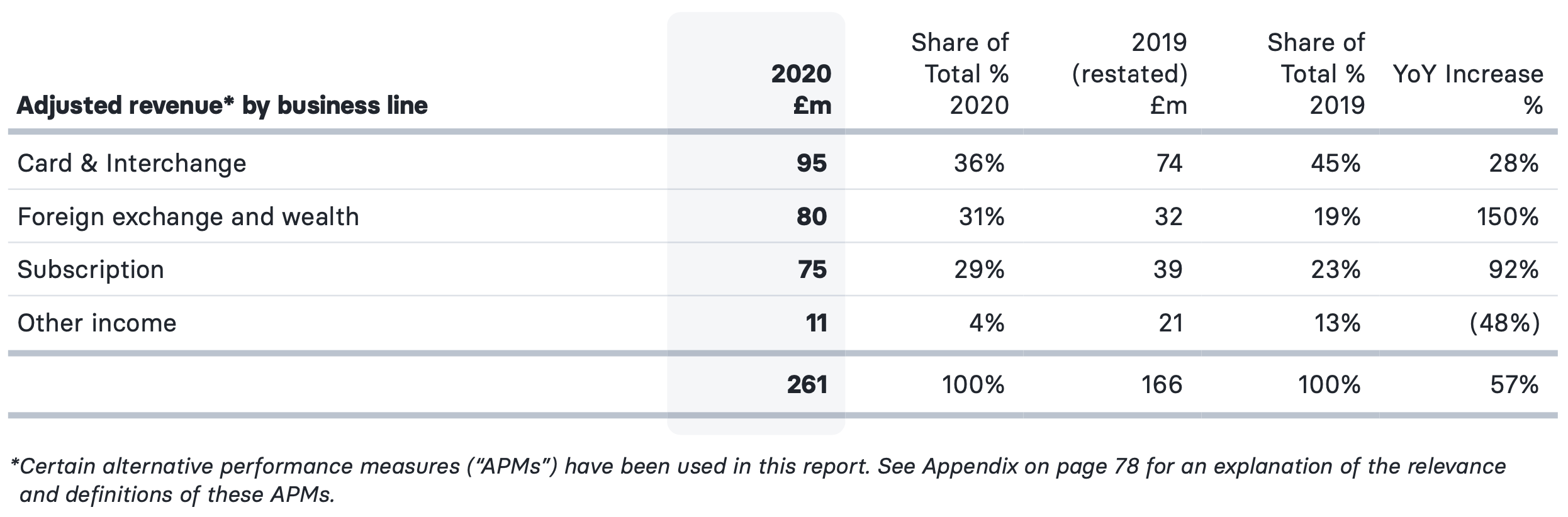

Apparently, interchange income from card transactions represents a superb chunk of the corporate’s income. In 2020, playing cards and interchange generated $131 million (£95 million) in income. Each time a Revolut buyer makes a card buy, the cardboard scheme (Visa or Mastercard) offers again some charges to Revolut. It’s an extremely small percentage-based price, however it may possibly add up whenever you generate thousands and thousands of purchases.

International alternate and wealth generated $111 million (£80 million) in income. That’s one other large one. And eventually, subscriptions, akin to Revolut Plus, Revolut Premium and Revolut Steel, accounted for $104 million (£75 million) in income.

These are three robust pillars that every one contribute to the corporate’s backside line. All of them signify a bit much less or a bit greater than a 3rd of the corporate’s general income.

Picture Credit: Revolut

Whereas the corporate has expanded aggressively through the years, the U.Ok. continues to be by far its greatest market. In 2020, 88.4% of the corporate’s (non-adjusted) income was associated to its actions within the U.Ok. The European Financial Space with out the U.Ok. represented 10.2% of income. The U.S., Japan, Australia and different markets had been almost negligible.

Revolut has additionally raised a mega spherical of funding in 2020 — a $500 million Collection D spherical that was prolonged to $580 million in whole. I wouldn’t be stunned if the corporate launches an preliminary public providing throughout the subsequent 12 months.