Newark, California-based electrical automobile producer Lucid Group, Inc’s battle towards buyers who’ve guess towards its share value on the inventory market continues to fluctuate. Lucid’s share value took a pointy downward flip final month when components together with the expiration of a share promoting lockup interval expired. This resulted within the short-sellers considerably extending their positive factors regardless of having taken losses earlier on. Now, after an upward rally that kicked off this month, the corporate’s short-sellers have misplaced a few of these positive factors by the shut of buying and selling on Monday, reveals contemporary information.

Lucid Group Brief Sellers Misplaced 13% Of Their Beneficial properties As Share Value Jumped Earlier This Month

In accordance with contemporary information shared by S3 Companions, LLC, year-to-date positive factors for Lucid Group’s quick sellers stood at $263 million shortly earlier than the shut of buying and selling on Monday. This reveals {that a} value enhance that ended yesterday noticed the bearish buyers reverse roughly 13% of the positive factors in rather less than two weeks since these positive factors had stood at a excessive of $302 million by noon on the third of this month. Lucid’s shares opened at $17.79 this month and closed at $20.06 on Monday, for 11% value progress.

Moreover, it additionally seems as if after extending their positive factors by the beginning of this month, a few of the short-sellers determined to name it quits. S3’s information exhibits that over the course of the final week, Lucid Group’s quick curiosity shares dropped by 377,000 to face at a complete of 43.7 million shares offered quick. This reveals an attention-grabbing truth, hinting that maybe the quick sellers had been content material with their positive factors made throughout August and had been desperate to keep away from an upward value run that kicked off earlier this month.

It is because ‘shortly’ after noon on the third, the quick curiosity shares stood at 46.4 million, and if, as S3 suggests, they dropped by 377,000 final week, then within the week earlier than that, the quick sellers decreased their bets by thousands and thousands of shares.

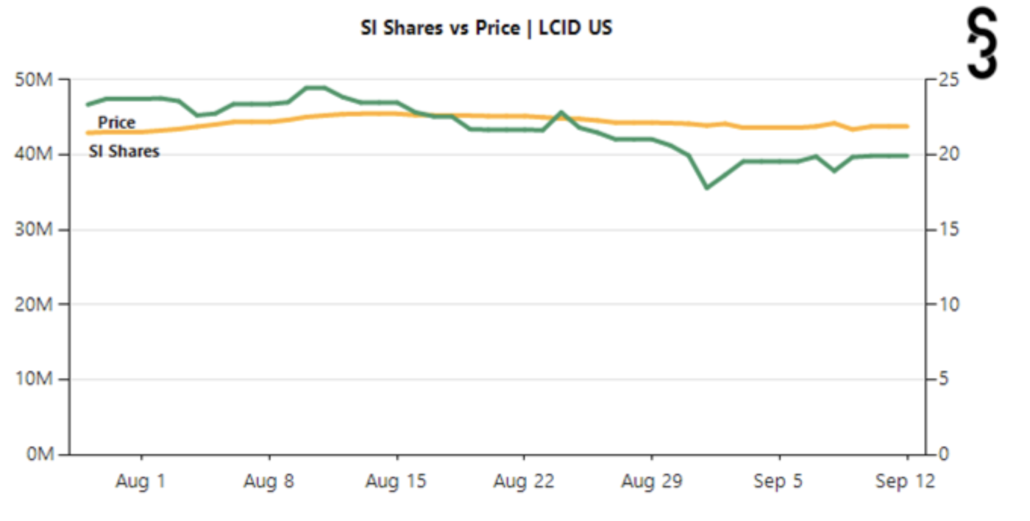

Value and quick curiosity information for Lucid Motors (NASDAQ: LCID) for the interval ranging from August and ending in mid-September. Picture: S3 Companions, LLC

Knowledge that listed down the quick curiosity shares by the third of this month had proven that the quantity stood at 46.4 million simply as September kicked off. This suggests that greater than two million quick curiosity shares have been faraway from the market since then. Nevertheless, this quantity is considerably larger than the info shared by S3 that we now have talked about above.

The discount within the shorted shares has additionally considerably introduced down the borrow charges for them. Brief sellers usually borrow an organization’s shares, on this case, Lucid Group’s shares, after which promote them in the marketplace. As soon as the share value drops, they repurchase a bigger variety of the shares via the quantity generated via their sale and preserve the surplus quantity after returning the borrowed inventory.

This borrowing comes with a charge, which stood at a excessive of 17.8% at the beginning of this month. This in itself was a major drop from the 33% charge by the tip of August. The charge has now dropped to a low 3.32%, indicating that the marketplace for borrowing shares for brief promoting has turn into extra liquid than earlier than. As an added spotlight, the charge stood at an eye-popping 74.3% throughout buying and selling on the twenty seventh of August.

Lucid Group is in a race with time to gear up its electrical automobile manufacturing and begin deliveries. The corporate’s Lucid Air is anticipated to have an extended driving vary over its rivals, however it can additionally come at a better value level, which is able to goal the luxurious section of the market. The corporate is likely one of the handful of electrical automobile producers in the US who’ve entered the market following elevated authorities and shopper curiosity within the sector.