Z1, a Sao Paulo-based digital financial institution aimed toward Latin American GenZers, has raised $2.5 million in a spherical led by U.S.-based Homebrew.

Various different traders additionally participated within the financing together with Clocktower Ventures, Mantis – the VC agency owned by The Chainsmokers, Goodwater, Gaingels, Soma Capital and Insurgent Fund. Notably, Mantis has additionally backed Step, a teen-focused fintech primarily based within the U.S., and Goodwater has additionally invested in Greenlight, which too has an analogous providing as Z1.

Z1 participated in Y Combinator’s Winter ‘21 batch earlier this 12 months, and on the time bought $125,000 in funding from the accelerator. Maya Capital led its $700,000 seed spherical in March of 2020.

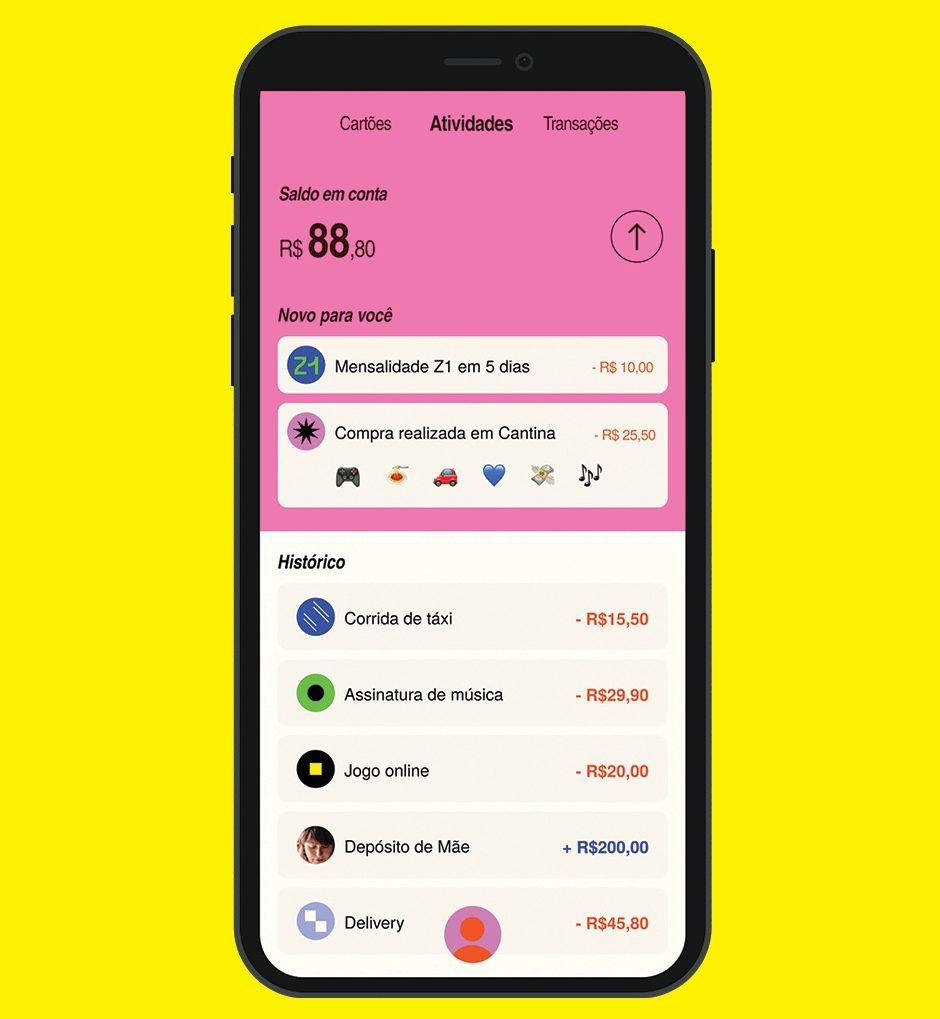

Put merely, Z1 is a digital financial institution app constructed for youngsters and younger adults. The corporate was based on the notion that through the use of its app and linked pay as you go card, Brazilian and Latin American youngsters can turn into extra financially unbiased.

João Pedro Thompson and Thiago Achatz began the corporate in late 2019 and shortly after, Mateus Craveiro and Sophie Secaf joined as co-founders. In its early days, Z1 is concentrated on Brazil however the startup has plans to develop into different nations in Latin America over time.

“Z1 is what we’re constructing to be the go to financial institution of the subsequent era, and never simply be a digital financial institution for teenagers,” Achatz instructed TechCrunch. “We wish to develop with him and sooner or later, be the largest financial institution in Brazil and LatAm.”

Thompson agrees.

“We’re buying customers actually early and creating model loyalty with the intention of being their financial institution for all times,” he mentioned. “We are going to nonetheless meet their wants as they develop into maturity.”

Picture Credit: Z1

Whereas Z1’s providing will not be utterly not like that of Greenlight right here within the U.S. the founders agree that its merchandise have been tailored extra to the Brazil-specific cultural and market state of affairs.

For instance, factors out Thompson, most youngsters in Brazil use money as a result of they don’t have entry to different monetary companies, whether or not they be conventional or digital.

“We provide an account the place they’ll deposit cash, money out cash through an immediate fee system in Brazil or spend by a pay as you go bank card,” he mentioned. “Most websites don’t settle for debit playing cards so this can be a large step in comparison with what teenagers have already got.”

A part of the corporate’s use for the capital is to make its product extra strong to allow them to do issues like lower your expenses for large purchases corresponding to an iPhone and earn curiosity on their accounts.

One other large distinction between Brazil and the U.S., the corporate believes, is that many dad and mom usually in Latin America haven’t had a real monetary schooling that they’ll go all the way down to their youngsters.

“We’re not high down like Greenlight,” Achatz mentioned. “That method doesn’t make sense in Latin America. Right here, many are unbiased from an early age and already work whether or not it’s by a microbusiness, a facet job or promoting issues on Instagram. They’re rather more self-taught and the earnings they earn is commonly exterior of their dad and mom.”

Z1 has grown 30% per week and 200% per thirty days since launch, spending “little or no” on advertising and marketing and relying totally on word-of-mouth. For instance, the corporate is following the lead of its U.S. counterparts and turning to TikTok to unfold the phrase about its providing.

“Step has round 200,000 followers on TikTok, and now we have slightly underneath half of that,” the corporate says. “We’re well-positioned when it comes to branding.”

For lead investor Homebrew, the chance to coach and supply monetary companies to Gen Z in Latin America is much more thrilling than the chance within the US., notes accomplice Satya Patel.

Over one third of LatAm Gen Z’ers have a “facet hustle,” producing their very own earnings unbiased from their dad and mom, he mentioned.

“Whereas millennials grew up throughout an financial growth, Gen Z grew up throughout recessions – 3 in Brazil during the last decade – and needs to turn into financially unbiased as quickly as potential. They’re changing into economically educated and lively a lot sooner than earlier generations,” Patel added.

He additionally believes the will to transact on-line, for gaming and leisure particularly, creates a groundswell of GenZ demand in Brazil for bank card and digital funds merchandise.