Sari-sari shops are neighborhood shops within the Philippines that normally promote day by day requirements and generally function neighborhood hubs, too. In the present day GrowSari, a startup that’s digitizing sari-sari shops with options like pricing instruments, stock administration and dealing capital loans, introduced it has raised a Sequence B from a number of notable traders that brings its complete funding to $30 million.

The corporate’s Sequence B is at a rolling shut, so it has not introduced a ultimate quantity. The $30 million complete it has raised embrace its seed funding and Sequence A, which according to the Ken was $14 million. Individuals in its Sequence B included Temasek Holdings’ personal fairness unit Pavilion Capital, Tencent, Worldwide Finance Company (IFC), ICCP SBI Enterprise Companions and Saison Capital, and returning traders Robinsons Retail Holdings (which is a part of the Gokongwei Group), JG Digital Fairness Ventures and Wavemaker Companions.

GrowSari was based in 2016, and says its B2B platform is presently utilized by greater than 50,000 shops in over 100 municipalities on Luzon, the Philippines’ largest and most populated island. Its final aim is to serve a million sari-sari shops.

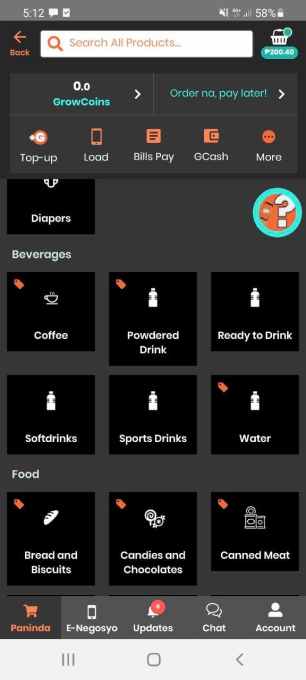

In keeping with GrowSari, there are greater than 1.1 million sari-sari shops within the Philippines, they usually account for 60% of fast-moving shopper items (FMCG) bought within the nation, making them a worthwhile distribution channel for wholesalers. Along with its provider market, GrowSari says it is ready to give sari-sari retailer operators higher pricing for merchandise from a few thousand FMCG manufacturers, together with Unilever, P&G and Nestle, which it claims will help shops double their earnings. Different companies within the app embrace on-line telecom and utility invoice funds, remittance and microfinancing for working capital loans.

GrowSari’s founding tDeam contains Reymund Rollan, Shiv Choudhury, Siddhartha Kongara and Andrzej Ogonowski, who first launched the platform as a backend system for sari-sari shops to handle their logistics and stock.

A screenshot of product classes in GrowSari’s app

Since most sari-sari shops are run individually, their margins are smaller than massive retailers that may negotiate offers with FMCG wholesalers. GrowSari’s provider market addresses this concern by giving sari-sari shops entry the Distributor Record Costs seen by massive shops and wholesalers. GrowSari’s market doesn’t require a minimal order, and it permits sari-sari shops on the platform to pay with money on supply, GrowCoins (or money credit that may be topped up by way of GrowSari’s shippers, on-line transfers, banks or over-the-counter at comfort shops) or E-Lista, GrowSari’s seven-day mortgage product.

GrowSari’s new capital can be used to increase its userbase to 300,000 new shops within the Philippines, particularly in Visayas and Mindanao, enhance the dimensions of its provider market and launch extra monetary merchandise for sari-sari shops. The startup is a part of a brand new crop of B2B platforms in Asia centered on serving micro to small-enterprises, together with BukuWarung and BukuKas in Indonesia and Khatabook in India.