Picture: REUTERS/Nick Zieminski

With the yr coming to an finish, the battle between retail and institutional traders that kicked off earlier this yr appears to have inflicted everlasting injury to the latter. The tussle was thrust into the limelight when in January and in Might this yr, the share costs of specialty retailer GameStop Company and theatrical exhibition enterprise AMC Leisure Holdings, Inc soared by as a lot as 1,019% as a result of retail camp uniting on social media platforms and buying the businesses’ shares in bulk.

This value enhance resulted in losses value billions of {dollars} for the institutional traders who had guess in opposition to each the businesses, in a course of known as quick promoting. The traders, who had been anticipating the share value to drop, reeled again in horror because it soared, inflicting some even to stop their operations.

Now, recent information for GameStop and AMC reveals that whereas the quick sellers are quickly recovering their losses, the speed is inadequate to make a dent into the billions that they’ve misplaced over the course of the yr.

GameStop & AMC Quick Sellers Get well $100 Million In Simply 5 Days Reveals Information

The most recent information, courtesy of S3 Companions, LLC, exhibits that by the tip of buying and selling on October eighth, the yr so far losses for GameStop and AMC quick sellers stood at $6.16 billion and $3.44 billion, respectively. These figures mark for a speedy price of restoration since information from the identical agency shared earlier this month revealed that by noon October 1st, the GameStop and AMC quick sellers had misplaced $6.21 billion and $3.49 billion, respectively.

Subsequently, within the 5 buying and selling days between the 2 time durations, the quick sellers had been capable of get well a cool $100 million. This brings up their recoveries because the third week of September to $920 million – or roughly $300 million per week.

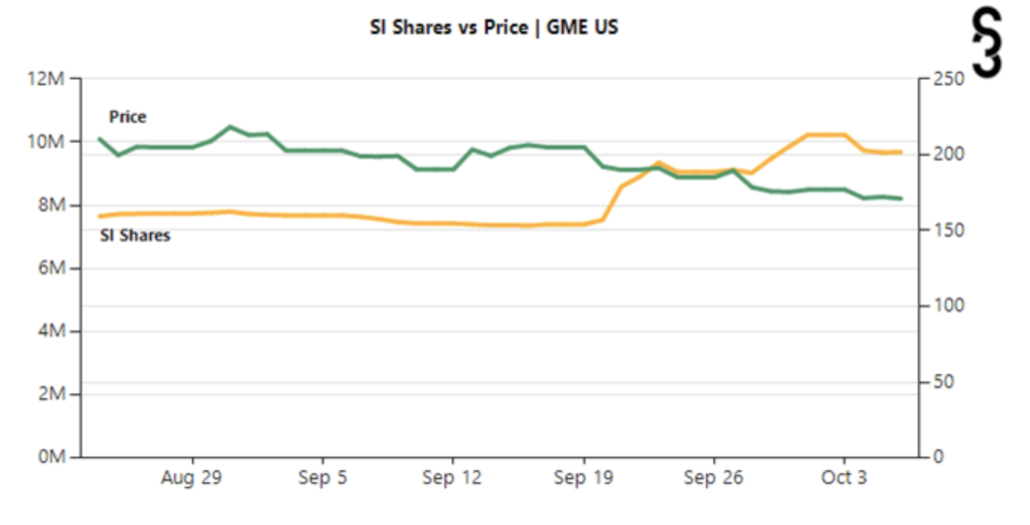

Information from the tip of this month’s first week reveals that GameStop quick sellers recovered $50 million in 5 days. Picture: S3 Companions, LLC

Whereas the majority of this common is because of recoveries made in late October, ought to this development proceed, then the quick sellers stand to get well their losses in 32 weeks or in roughly eight months. Each AMC and GameStop’s share costs have been on a downward development over the previous thirty days, with the previous having dropped by 11.5% and the latter by 11.2%.

Nonetheless, once we have a look at the share costs over the previous six months, the case for the quick sellers recovering their losses weakens. Throughout this time interval, GameStop’s share value has appreciated by 18.5% and AMC’s value by a whopping 336.7%.

But, the latest downward value developments have injected some optimism into the quick sellers. As the newest information exhibits, whereas the expansion development for AMC’s quick curiosity shares has remained comparatively static, for GameStop, it has been on the rise since mid September, owing to the share value drops.

The variety of these shares, which characterize these which were borrowed by the institutional camp and offered available on the market in hopes for the share value to drop, is disputed by the retail camp, which alleges that the institutional traders are hiding the true nature of their positions.

Quick curiosity shares for GameStop have dropped this month after rising in September, and darkish pool information for general trades reveals that 42% of the trades for GameStop shares had been made in darkish swimming pools on Friday. Darkish swimming pools are non-public boards that permit giant traders conceal their identities, and for AMC, a staggering 62% of all trades had been in the dead of night pool on the identical day.