Palo Alto, California-based electrical automobile producer Tesla Inc’s chief government officer Mr. Elon Musk has expressed confusion on the hovering valuations of recent entrants into the area. Tesla, the primary American firm to fabricate and promote electrical autos able to exceeding 200 miles in touring vary, is now enjoying in a market the place different firms plan to launch their merchandise. One firm that has caught client curiosity is one other Californian firm, now known as Lucid Group who plans to ship its luxurious Lucid Air electrical sedan to its prospects this month.

Elon Musk Expresses Confusion At Hovering Valuations Of Lucid Group and Rivian Automotive

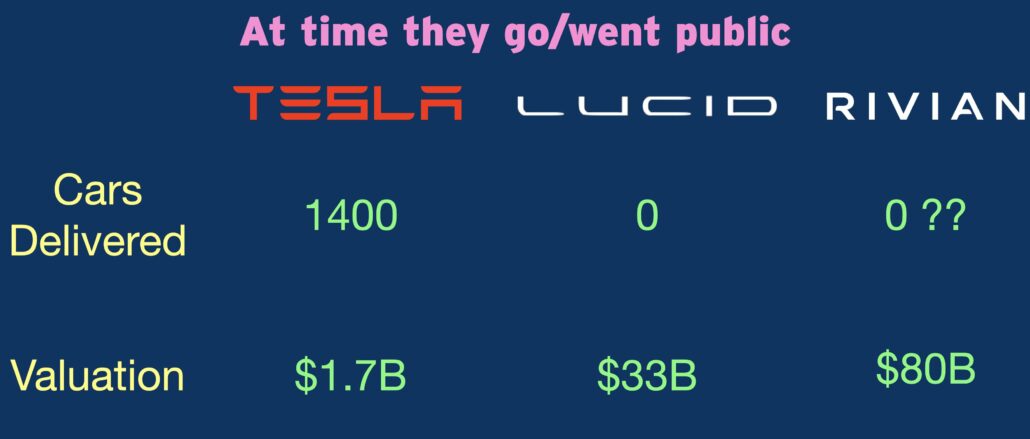

Musk made his newest feedback on the hovering valuations of Lucid and Rivian on the social media platform Twitter. He responded to a tweet evaluating the valuation of Tesla when it went public with those the opposite two have secured far. This knowledge was offered alongside deliveries made by the three firms, and it revealed that whereas Tesla had delivered 1,400 autos when it went public, the others are but to make a single one.

The present state of the electrical automobile business is considerably totally different from when Tesla determined to promote its shares to most of the people. This modification, which is generally attributable to Tesla’s success, has resulted in sturdy retail and institutional investor enthusiasm for the sector, and it’s this transformation that Mr. Musk described as “unusual.”

After Tesla was included in 2004, Musk joined the corporate lower than a 12 months later when he invested $6.5 million within the firm and have become its board chairman. He would then develop into Tesla’s chief government, a job that allowed him to supervise the corporate’s each day operations instantly, quickly after Tesla’s earliest co-founders Marc Tarpenning and Martin Eberhard, departed from the corporate.

A picture tweeted by Twitter person @WR4NYGov evaluating the supply and valuations of Tesla, Rivian and Lucid once they went public. Observe: Rivian is but to promote its shares publicly, however it has disclosed a valuation of $80 billion. Picture: @WR4NYGov/Twitter

The chief’s preliminary response to the picture tweeted (proven above) merely said that:

These are unusual days

He then questioned whether or not it was attainable within the present surroundings for a corporation to market itself as growing electrical autos and safe a valuation lesser than $1 billion with out making any deliveries.

Musk’s remarks on this facet have been as follows:

If it attainable to begin an EV firm with out transport any vehicles & get a valuation lower than a billion {dollars}!?

Musk, who has shared his struggles with executing mass manufacturing a number of instances, added a cautionary word for brand new entrants into the electrical automobile market. Previous to questioning about valuations, he cautioned them to be cautious of the troubles that accompany scaling up a brand new firm’s operations in a number of enterprise areas.

In response to him:

I hope they’ve a excessive ache tolerance. Scaling manufacturing, provide chain, logistics & service is a world of harm.

Lucid Group’s Lucid Air luxurious electrical automobile is the discuss of the city. Picture: Andrew Krok/Roadshow

Since Tesla began promoting the Roadster in 2008, the business has considerably grown, and Lucid Group’s Lucid Air is a automobile that has impressed buyers and reviewers alike. The Air has an Environmental Safety Company (EPA) estimated vary of as much as 520 miles (for the upper finish variants), and reflecting its luxurious nature, the automobile has a beginning value exceeding $70,000.

Rivian, alternatively, focuses on sports activities utility autos (SUVs), pickup vans and supply vans. The corporate’s vans have already obtained an order from retail big Amazon, and it kicked off manufacturing of its R1T pickup truck in September this 12 months.

Then again, Tesla delivered roughly 1 / 4 of 1,000,000 autos within the third quarter of this 12 months, representing roughly half of the corporate’s deliveries made throughout 2020. Its success with a producing facility in China injected contemporary optimism into the corporate, which buyers rewarded through a meteoric rise in share value. Because the begin of 2020, Tesla’s share value has grown by an astounding 880%, and since its preliminary public providing, the shares have appreciated by an eye-popping 21,853% based mostly on closing costs this Friday for a market worth of $834 billion.