Within the wake of Coinbase’s direct itemizing earlier this 12 months, different crypto firms could also be trying to go public earlier than later. That seems to be the case with Circle, a Boston-based know-how firm that gives API-delivered monetary providers and a stablecoin.

The Trade explores startups, markets and cash.

Learn it each morning on Additional Crunch or get The Trade publication each Saturday.

Circle is not going to direct checklist or pursue a conventional IPO. As a substitute, the corporate is combining with Harmony Acquisition Corp., a SPAC, or blank-check firm. The transaction values the crypto store at an enterprise worth of $4.5 billion and an fairness worth of round $5.4 billion.

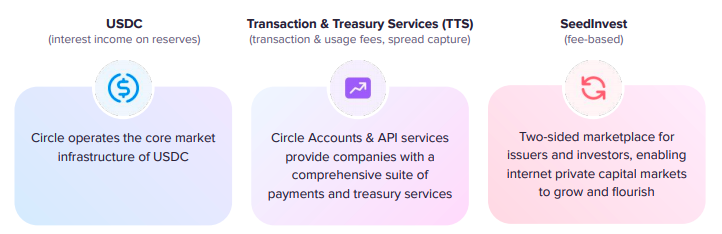

Circle’s SPAC presentation particulars an organization whose core enterprise offers with a stablecoin — a crypto asset pegged to an exterior forex, on this case, the U.S. greenback — and a set of APIs that present crypto-powered monetary providers to different firms. It also owns SeedInvest, an fairness crowdfunding platform, although Circle seems to generate the majority of its anticipated revenues from its different companies.

For extra on the deal itself, TechCrunch’s Romain Dillet has a bit targeted on the transaction. Right here, we’ll dig into the corporate’s investor presentation, discuss its enterprise mannequin, and riff on its historic and anticipated outcomes and valuation multiples.

In brief, we get to have just a little enjoyable. Let’s start.

How Circle’s enterprise works

As famous above, Circle has three principal enterprise operations. Right here’s the way it describes them in its deck:

Picture Credit: Circle investor presentation

Let’s contemplate every one, beginning with USDC.

Stablecoins have turn out to be common in latest quarters. As a result of they’re pegged to an exterior forex, they function as an fascinating type of money contained in the crypto world. If you wish to have on-chain shopping for energy, however don’t need to have all of your worth saved in additional risky, and tax-inducing, cryptos that you simply might need to promote to purchase anything, stablecoins can function as a extra secure form of liquid forex. They’ll mix the soundness of the U.S. greenback, say, and the crypto world’s fascinating monetary internet.