American Specific is branching out into monetary planning, with just a little assist from a seven-person startup referred to as BodesWell.

This week, the bank card big launched a pilot of its first self-service digital monetary planning software, dubbed “My Monetary Plan (MFP).” The six-month pilot kicked off on July 11 with about 25,000 choose Amex cardmembers.

American Specific quietly invested in BodesWell in late 2020 by way of its enterprise arm, Amex Ventures. Since then, the monetary companies behemoth teamed up with the tiny startup to develop the monetary planning software for its customers. The brand new product is designed to offer customers a whole image of their monetary well being and assist them make and obtain main life targets, similar to shopping for a home or retirement.

TechCrunch talked with Amex Ventures’ Julia Huang, who led the funding and technique across the new product, and BodesWell co-founder and CEO Matthew Bellows to be taught extra particulars.

The pair really met whereas serving on a panel collectively in 2019.

“I used to be drawn to the truth that it was not a round-up financial savings software, however moderately a holistic software to perceive your full monetary image that might be used to plan for the monetary influence of your life choices,” Huang informed TechCrunch.

Earlier than deciding to spend money on BodesWell, Huang says Amex Ventures — which over time has backed greater than 70 startups — had “evaluated the area fairly extensively.”

Huang launched Bellows and his employees to Amex’s Digital Labs group and so they launched into collectively creating a specialised providing for Amex prospects. (Whereas Bellow relies in Boston, he says the startup is “globally distributed.”)

“Our purpose is to democratize monetary planning with our cardmembers by offering detailed insights and forecasts to assist them with their holistic planning,” she informed TechCrunch.

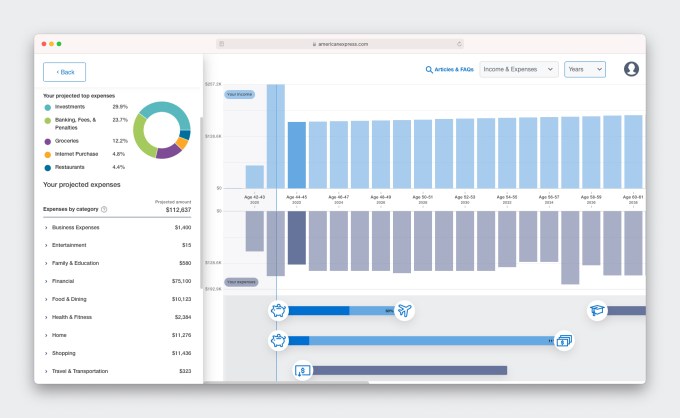

Picture Credit: Amex Ventures

Bellows began BodesWell in early 2019 with the purpose of empowering shoppers and prospects to construct their very own monetary plan.

“A lot of monetary planning software program is geared toward monetary advisors, and requires them to run it,” he mentioned. “So, most individuals can’t get the advantages of monetary planning…Our hope is to broaden advantages to much more folks.”

BodesWell will information customers in establishing a monetary plan and can work even higher in the event that they sync with their different monetary info by way of Plaid so it may possibly “replace in actual time,” Huang mentioned.

The software “takes into consideration earnings, belongings, bills and liabilities — what money movement seems to be like holistically in order that customers can drag & drop to plan life occasions,” Bellow mentioned.

An estimated 85 million American households don’t have a monetary, planner for a wide range of causes — together with distrust of a planner’s intentions or simply feeling overwhelmed by the method.

The product is free in the course of the pilot section and American Specific hasn’t but decided if it should cost for it afterwards.

“We’re gauging first for engagement and the ability of the product for our prospects,” Huang informed TechCrunch. “We need to be sure that the product resonates and that we iterate on the product to ensure it’s good for the broader inhabitants. Our major purpose is that our prospects use it and discover it beneficial.”

Amex Ventures has fashioned “some stage of partnership” with greater than two-thirds of its portfolio firms, she added.

“We attempt to interact with our portfolio in that manner, to supply worth with our startup ecosystem,” Huang mentioned.

For its half, BodesWell had beforehand raised about $1.5 million from traders similar to Cleo Capital, Ex Ventures, Riot.vc, GritCapital and Argon Capital and angels like HubSpot CEO Brian Halligan and Kintent CEO Sravish Sridhar.